Overview

Business owners in Uganda cite the lack of appropriate capital as the biggest hindrance to their success. However, investors including impact funds, banks and private equity investors disagree. They contend that the majority of SMEs in Uganda are not investment ready. SME owners are either not aware of the alternatives to bank debt finance in Uganda or they are unwilling to seek these alternative sources of finance. In addition, those who are willing do not understand what investors are looking for or how to “sell” themselves and their businesses to potential investors.

In this article, we define investment readiness and provide a roadmap for SMEs seeking to access alternative sources of growth capital.

What is investment readiness?

Investment readiness is the capacity of an enterprise to understand and meet the specific needs and expectations of investors, and it plays a critical role in shaping whether a business receives investor funding. There are three dimensions of investment readiness: equity aversion; business viability and quality of investor materials.

Equity aversion concerns the entrepreneur’s attitude towards equity finance. Consistent with the pecking order hypothesis there is a high level of equity aversion amongst SMEs. The pecking order hypothesis states that companies prefer to finance themselves through first retained earnings, then debt and finally through the issuance of new equity. Most high growth business owners are reluctant to surrender ownership and control. Equity aversion is also related to the entrepreneur’s lack of information about the characteristics and availability of alternative sources of finance. The consequence is that many potentially investable projects opt for usually inappropriate bank debt financing, often to the detriment of their long term viability.

Business viability is the second dimension of investment readiness. The high rejection rates of business banks and private equity funds clearly indicates that most businesses that seek external finance do not meet the requirements of external investors. The investment decision-making process involves two stages. At the first stage the opportunity is assessed against the investor’s investment parameters – for example, sector, stage of business, size of investment, location. The first concern of investors when appraising an investment opportunity is the “goodness of fit‟ between the opportunity and their own personal investment criteria. Investors reject investment opportunities which do not meet their investment parameters. Lack of information – or failure to seek out the information that does exist – explains why entrepreneurs make approaches to inappropriate investors.

During the second stage of business viability assessment, the investor selects those businesses which meet their investment parameters. Deals are rejected during this stage for three major reasons: weaknesses in the entrepreneur/management team; marketing and market-related factors, notably flawed or incomplete marketing strategies; and financial considerations, notably flawed financial projections.

A study of investment decision making by UK business angels based on business plan summaries indicated that they were turned off by businesses that lack focus; where comprehensive and credible market information is lacking; that operate in highly competitive markets; and lack a unique selling point (USP) (i.e. “me too” products and services). Investors wanted to understand the way that the product or service is distinctive or superior to that of the competition and how any competitive advantage will be sustained. They also placed considerable emphasis on the experience and track-record of the entrepreneur, his/her commitment, the upside potential of the business, and the use to which the finance that is sought will be put.

The third dimension of investment readiness is quality of investor materials. Even if the underlying proposition is sound, a business may still fail to raise finance if the business plan is poorly constructed and presented. This includes shortcomings in business plans and other written documents that are aimed at investors and also deficiencies in “pitches” at investment forums. Investors are frustrated by missing information in business plans, particularly when it relates to any of the generic questions that investors ask of any investment proposal. Poor oral presentation is likely to generate a negative reaction amongst potential investors. Poor presentation is often interpreted by some investors as a warning signal for the entrepreneur’s wider lack of competence: “if he can’t sell to investors, how can he sell to customers?”.

The benefits of investment readiness

Investment readiness has multiple benefits for businesses:

(a) Businesses understand themselves better. Investment ready businesses understand their capital needs and are aware of the capital available to them. Such businesses are best placed to manage external financing.

(b) Businesses can engage better with investors to raise external capital. An investment-ready business can more easily raise external capital as it is prepared to meet the needs and expectations of investors.

(c) Investment readiness accelerates the capital raise process. Businesses will have their documents and information prepared in advance, which will shorten the due diligence process and minimize other process delays.

The capital raising process

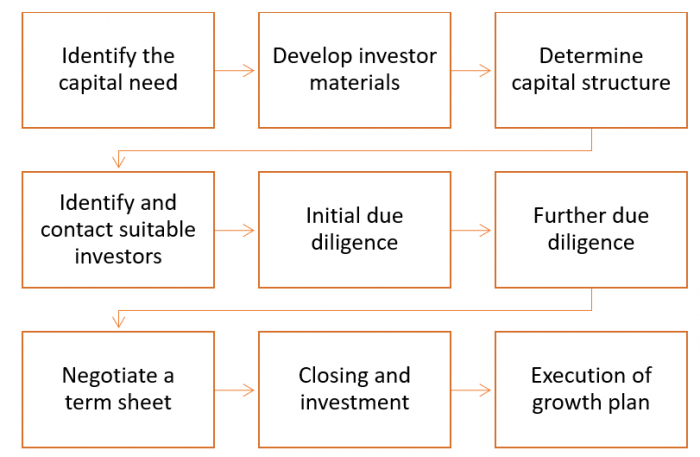

Raising capital is typically a multi-step process involving preparation, investor engagement and execution. This process typically takes between three and eighteen months but could last longer.

Figure 1 The capital raising process

Features of an investment ready business

Businesses improve the odds of a successful capital raise by addressing the key dimensions that investors use to evaluate investment readiness. In other words, businesses should endeavor to achieve the features of an investment ready businesses summarized in Table 1.,

Table 1 Features of an investment ready business

| Dimension | Features of investment readiness |

| Market landscape | Clearly defined target market with an understanding of the competition and risks |

| Business model | Proven and efficient processes and partnerships to ensure implementation of the model |

| Team | Competent and motivated team with clearly defined roles in the business |

| Traction to-date | Positive trend in the financial and operational indicators that are regularly monitored |

| Growth strategy | Well-defined growth strategy with detailed financial projections and a formally documented business plan |

| Capital need | Defined capital requirement outlined in an investor teaser and memorandum |

| Governance | Clearly defined governance mechanisms and controls |

The JSR investment readiness program

Our investment readiness program has two elements:

(a) Information Provision

Through broadly targeted information workshops focused on equity as an alternative source of finance for SMEs at all stages of development. We address the following key matters:

- what equity is and the benefits it may bring

- the limitations of debt funding and when it should be considered

- the different types of equity providers in the market place and their specific focus

- how to access the right investor

- equity investors’ evaluation process and decision-making criteria

- how to present information which addresses the investor perspective

- determining realistic funding needs for the future

- what to expect in relation to the equity parties control and legal safeguards for the future

- risk and return aspects of equity investment and the determination of “value”.

(b) Investment Readiness Reviews

We focus on those attendees at the information workshops who decide to progress as candidates for equity finance. We work with these businesses on a one-on-one basis to assess their suitability to raise equity finance. We cover such issues as:

- what are the entrepreneur’s aspirations?

- how experienced is the entrepreneur and management team?

- can the management team successfully execute the business strategy?

- is the market opportunity clearly articulated?

- can the business provide a reasonable and realistic business plan?

- can the entrepreneur articulate how the finance will be utilized?

- what is the likely rate of return on an investment?

- are the corporate governance processes appropriate?

- is there the likelihood of an exit strategy?

(c) Investment Ready Program

We then work with those businesses that receive a positive assessment to address issues raised by the investment readiness review. The objective is to accelerate companies to the stage of positive cash flow as soon as possible because such companies are easier to “sell” to investors than those that are still at the ideas stage. We address such issues as the management team, boards, intellectual property, market analysis, market positioning and market validation, business models, competition, differentiation and barriers to entry, future products/services, and financial planning.

(d) Investment Presentation Review

The fourth and final element is an Investment Presentation Review to assist companies to prepare a “winning” investment presentation. Presenting an opportunity effectively to potential investors is one aspect of being “investor ready” as it requires an understanding of what investors look for in an opportunity and an ability to anticipate and address the concerns of investors. Central to this presentation is the use of information which demonstrates and signals personal and organizational competence and the entrepreneur’s abilities and motivations. This includes an awareness of deal structures and valuation.

Robert Katuntu is a Partner at J. Samuel Richards & Associates, Certified Public Accountants

Contact us:

Regency Plaza, 30 Lugogo Bypass

PO Box 22934 Kampala, Uganda

Email: info@jsamuelrichards.com

References

- OECD Discussion Paper on Investment Readiness Programmes

- Energy Catalyst Investment Guide – June 2020