According to the Uganda Retirement Benefits Regulatory Authority (URBRA) Pension Digest 2021, interest declared by retirement benefits schemes (RBS) in Uganda varied from 8.0% to 18.5% per annum. Evidently, some RBS are more successful in delivering value to their members. What factors distinguish outperforming RBS from the rest of the pack?

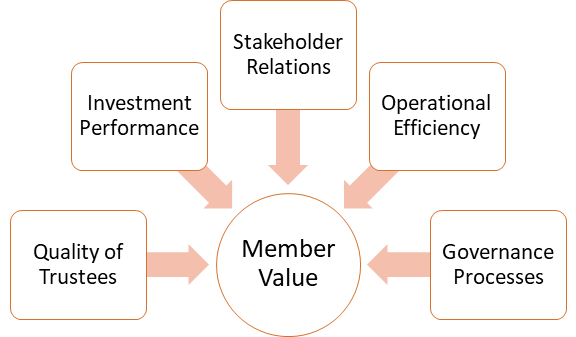

Our analysis identified five key drivers of superior RBS members’ value:

1. Effectiveness of the Board of Trustees

The trustees have a fiduciary duty to manage all aspects of the RBS. The effectiveness of the of individual trustees (and collectively as a board of trustees) is the primary determinant of RBS performance. RBS with effective boards of trustees tend to outperform those with inadequate trustees. Exceptional trustees have a number of qualities including: integrity, good judgement, financial literacy, and willingness to commit their time and effort to the business of the RBS. Effective trustees also have a working knowledge of the key disciplines of Finance and Accounting and actively engage with the RBS sponsor, service providers and other stakeholders. RBS looking to improve the effectiveness of their boards should therefore pay attention to the quality of individuals nominated to their boards. Once nominated, trustees should receive ongoing professional development and be subject to regular performance evaluation.

2. Superior investment performance

Nearly all RBS revenues are generated from investments. To achieve superior investment performance, the trustees must carefully manage the RBS investment portfolio. There are a number of drivers of superior investment performance:

- An appropriate investment strategy

- Proper understanding of the macroeconomic factors which have a bearing on the investment management policy

- Effective monitoring and evaluation of relative and absolute investment performance

- Effective monitoring and evaluation of the fund managers’ stated investment strategy, portfolio management style and overall performance

- Understanding the sectors, technologies and companies which are the particular focus of the portfolio

- Setting parameters for, and monitoring, evaluating and controlling investment risk.

Whilst actual investment management is delegated to authorized fund managers, the trustees should actively monitor the fund Managers’ performance and obtain reasonable assurance that the RBS portfolio is on track to achieve the set goals.

3. Stakeholder relationships

RBS have a number of important stakeholders including the sponsors (employers) and various service providers. In addition to remitting the monies that are the foundation of the RBS, employers provide an enabling environment for RBS success. Other stakeholders including administrators, custodians, fund managers and external auditors provide vital professional services to RBS. High-performance RBS have a symbiotic relationship with their stakeholders, recognizing that the sponsor and the service providers greatly influence the future success of the RBS. These relationships should be managed as strategic partnerships and must be supported by clear terms of reference, service level agreements and ongoing evaluations to ensure that the mutual objectives are achieved.

4. Operational efficiency

Operational efficiency measures the ability of the RBS to minimize resource waste, while maintaining a high-quality service. The cost-income (or cost-contributions) ratio is a measure of cost-efficiency; essentially how much of the annual RBS income earned (contributions received) is spent on operating costs. The trustees should pay attention to the drivers of RBS cost including service provider fees, management and other operational costs. These costs should be actively negotiated with a view to maximizing members’ value. A useful approach is to benchmark relative costs to other RBS and seeking explanations for any significant variances.

5. Governance Processes

Governance processes comprise rules and practices that determine how the RBS operates and aligns the interests of all its stakeholders. Good governance begets ethical business practices which lead to enhanced member value. RBS trustees should seek to entrench good governance by ensuring compliance with applicable laws and regulations, the effectiveness of board meetings, evaluation of board structures, competence and succession planning. Outperforming Boards should actively seek an independent evaluation of their performance. The Board performance evaluation should assess all aspects of RBS performance including the performance of the Board on its core responsibilities, RBS strategy, key processes, systems and internal controls. The independent evaluation should also assess the performance of the RBS service providers.

Conclusion

Stakeholders must recognize that RBS are unique institutions, with tailored-made governance and operational processes. Trustees will maximize member value by carefully optimizing the foregoing drivers of superior member value.

For further information, contact us at:

J. Samuel Richards & Associates

Certified Public Accountants

Regency Plaza, Plot 30 Lugogo Bypass

PO Box 22934 Kampala, Uganda

www.jsamuelrichards.com

info@jsamuelrichards.com