A good ICAAP should meet the following standards:

- Formalized and documented;

- Sufficiently detailed – estimates current and prospective capital for 3-5 years;

- Subject to internal review and approval by management and the board;

- Comprehensive in coverage of risks (identify and allocate capital);

- Indicative of the interactions between the various risks;

- Relates the financial institution’s capital adequacy goals to risks, strategic focus and business plan;

- Assures the integrity of the overall process;

- Integrates policies and controls for regular validation of the methodology, data, systems and processes;

- Exhibits a simple and intuitive presentation.

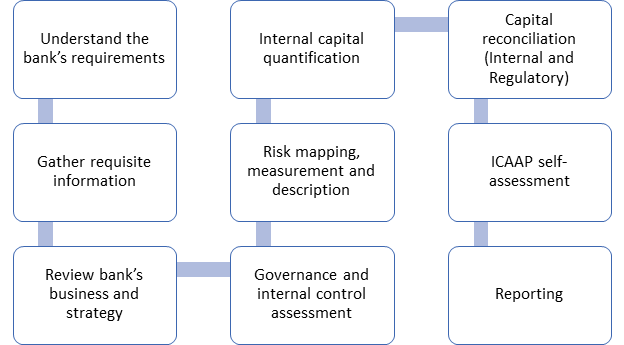

JSR has a structured approach to ICAAP that starts with understanding your business:

We have a team of uniquely qualified and experienced ICAAP consultants led by:

Robert Katuntu, CFA, CPA, MBA (+256 786 624855)

Albert Otete, PhD, CPA (+256 772 703444)