ICAAP is a risk management process, a key aspect of Basel III. It is a process through which a bank identifies, measures, aggregates and monitors material risk. The bank ultimately builds a risk profile that becomes the basis for allocating capital.

Under Basel III, bank supervision is moving to Pillars 2 and 3, which are driven by risk management and market discipline, respectively.

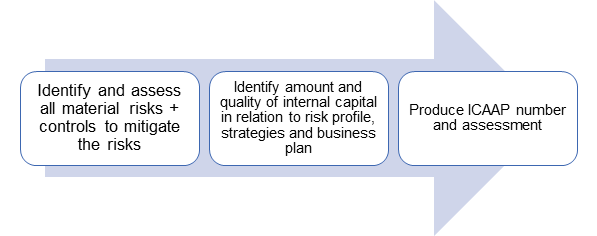

Supervised financial institutions develop an ICAAP document that ensures that total capital levels are adequate. In addition, capital must be consistent with strategies, business plans, risk profiles and operating environment. The ICAAP process is underpinned by strong governance processes:

JSR has a structured approach to ICAAP that starts with understanding your business. We have a team of uniquely qualified and experienced ICAAP consultants led by:

Robert Katuntu, CFA, CPA, MBA (robert.katuntu@jsamuelrichards.com) and

Albert Otete, PhD, CPA (albert.otete@jsamuelrichards.com)