The investor should not hurry to sell just because the price has fallen. However, selling remains an option.

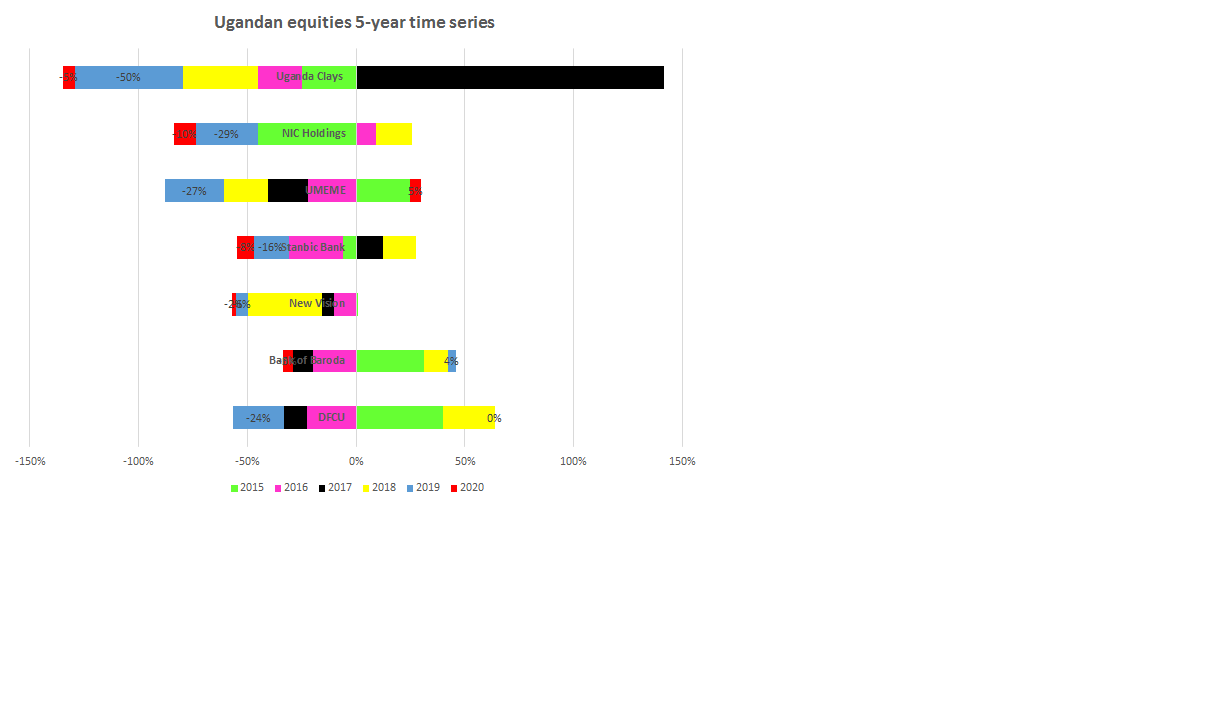

In regard to selected Ugandan equities, Uganda Clays appears to be an outlier with huge swings at both ends of the continuum. Nonetheless, lets pay attention to stocks that had consecutive decline in 2018 (YELLOW), 2019 (BLUE) and 2020 (RED). These include Uganda Clays, New Vision. On the Kenyan side, the stocks included Kenya Airways, Jubilee Holdings, NMG, CIC Insurance, Britam and Bamburi Cement. After a consecutive downward trend in prices, the cumulative gains become increasingly depleted or the cumulative losses keep mounting. In such circumstances, an investor may set a deadline after which may sell the shares to stop any further misery.

The global Covid-19 pandemic has caused financial distress more than the 2008 global financial crisis. However, there are some stocks that were already depressed even before Covid-19. The fundamentals of some of the listed companies have been worsened Covid-19 lockdown which has affected production and demand. If the fundamentals do not return to normal by 30 June 2020, then the stocks may not rally in time to bounce back by 31 December 2020.

If an investor sells, what to do with the cash? At the moment, fixe income investments like treasury bills may be a short-term solution while watching the movement of interest rates in Government bonds. With general elections coming up in Uganda in 2021 and Kenya in 2022, the interest rates may go up as Governments need to borrow domestically to plug gaps in domestic revenue.

Falling equity prices could also be an opportunity to buy stocks at give-away prices. Pension trustees and fund managers could look into the fundamentals of some of the companies and try their luck on the hockey stick.