Why businesses should actively pursue mergers and acquisitions

November 30, 2022 By Robert Katuntu

By Robert Katuntu, CFA, CPA

robert.katuntu@jsamuelrichards.com

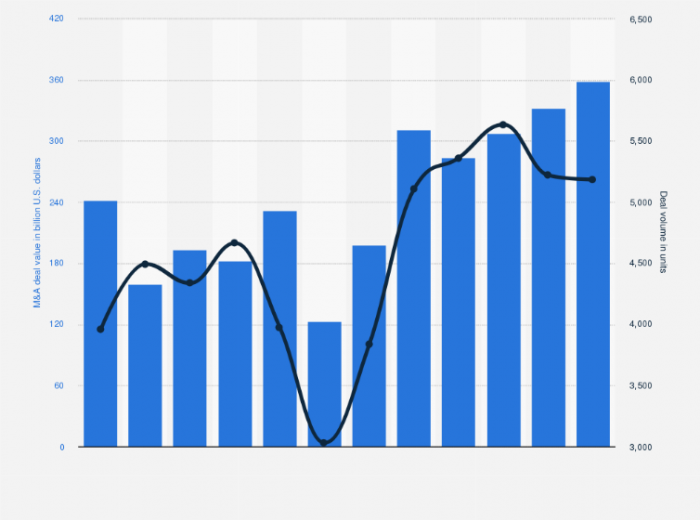

According to Boston Consulting Group, the total value of Mergers and Acquisitions (M&A) through as of July 2022 was US$ 1.7 trillion! Here are seven reasons why businesses should actively pursue M&A:

- Synergies – by combining business activities, overall performance efficiency tends to increase and costs tend to drop, because each company benefits from the other’s strengths.

- Growth – the acquiring company can quickly grow market share.

- Increase supply chain pricing power – by buying out one of its suppliers or distributors, a business can eliminate an entire tier of costs.

- Eliminate competition – an acquirer may eliminate future competition and gain a larger market share.

- Reduce risk – running a business is a risky endeavour, M&A may eliminate duplicated risks or spread them over a larger base

- Orderly exit – M&A is the most viable exit mechanism for most private businesses; most businesses cannot achieve an Initial Public Offer based exit

- Raise cash and/or diversification – rather than an outright sale, M&A may be a suitable avenue to raise cash and diversify a concentrated equity position.

Robert Katuntu, CFA, CPA is a Chartered Financial Analyst at J. Samuel Richards & Associates based in Kampala, Uganda. Robert has over 32 years’ experience in business leadership and management consultancy in East Africa. Robert has extensive experience in auditing, finance, banking, business strategy and management consultancy.