Airtel Uganda Investment Commentary FY2025 – 23Feb26

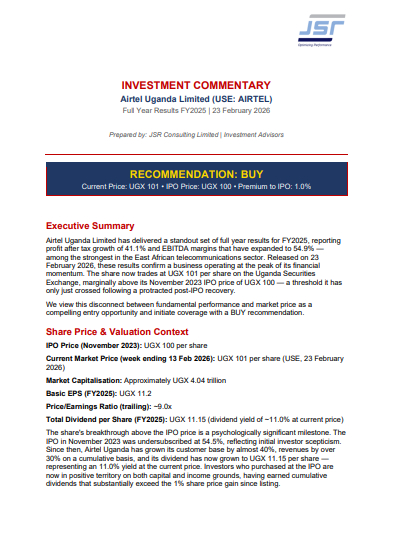

Airtel Uganda Limited (USE: AIRTEL) Full Year Results FY2025 | 23 February 2026 Prepared by: JSR Consulting Limited | Investment Advisors RECOMMENDATION: BUY Current Price: UGX 101 • IPO Price: UGX 100 • Premium to IPO: 1.0% Executive Summary Airtel Uganda Limited has delivered a standout set of full year […]